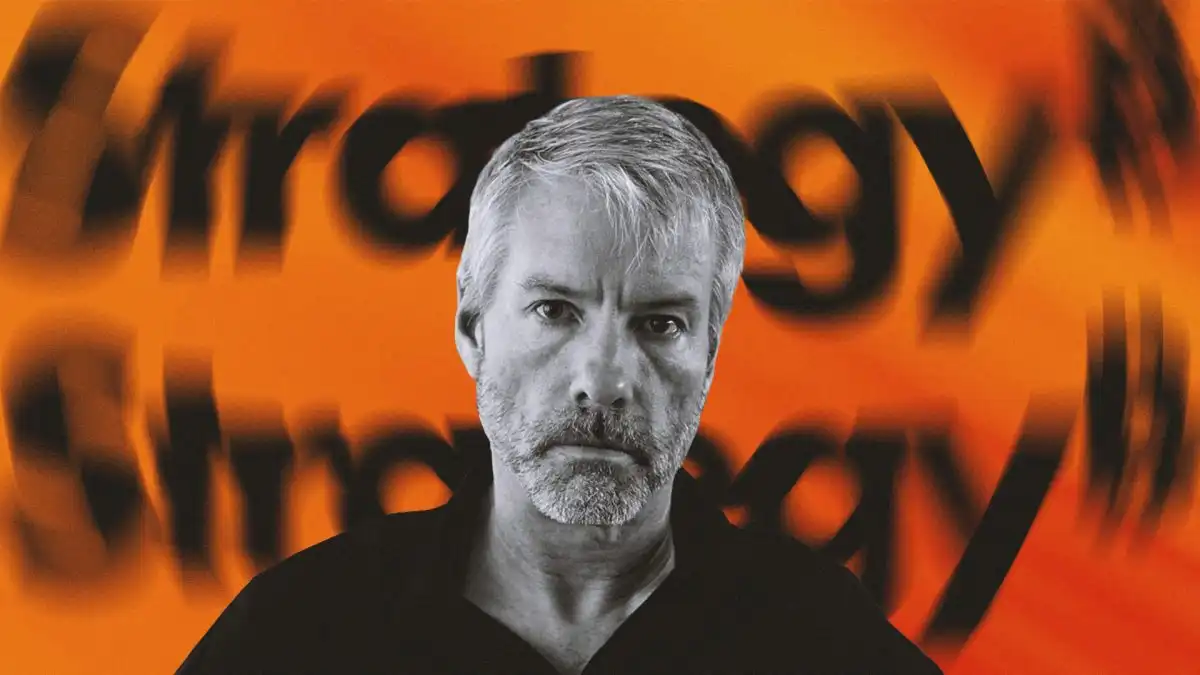

Deck: Understanding Michael Saylor’s recent statements and MicroStrategy’s Bitcoin position to cut through the panic and uncover the real investment implications.

Introduction

News that Michael Saylor, MicroStrategy’s founder, might sell his massive Bitcoin holdings sparked panic across crypto Twitter. With MicroStrategy holding approximately 650,000 BTC, any significant Bitcoin sell-off from the company could disrupt markets. But is this fear justified? In this article, we dissect Saylor’s recent comments, analyze MicroStrategy’s financial health, and explain why the likelihood of a mass liquidation is very low. If you want clarity on this high-profile Bitcoin holder’s strategy and what it means for investors, read on.

Michael Saylor’s Bitcoin Sell-Off: What Did He Really Say?

On a recent conference call, Michael Saylor admitted MicroStrategy could sell Bitcoin under certain circumstances. His exact words were:

“Yes, we could sell bitcoin derivatives. And we would do that because that’s in the best interest of the shareholders.”

To clarify:

- Saylor did not say he will sell Bitcoin, only that selling could happen.

- The company might sell spot Bitcoin or derivatives — contracts that can amplify profit or loss without selling actual Bitcoins.

- This admission triggered headlines suggesting an imminent Bitcoin dump, but those claims miss crucial context.

What Are Bitcoin Derivatives?

Bitcoin derivatives are financial contracts whose value is based on Bitcoin’s price. They let traders bet on Bitcoin falling or rising without moving actual Bitcoins. This can hedge risk or speculate, but derivatives can also be riskier than holding Bitcoin outright.

MicroStrategy’s Bitcoin Position Is Robust

Key Financials:

| Metric | Value |

|---|---|

| Bitcoins held | ~650,000 BTC |

| Bitcoin Value (approx.) | $59 billion (USD) |

| Company Valuation | $68 billion (USD) |

| Debt | $8.22 billion (USD) |

| Debt-to-Bitcoin Value | ~11% |

Despite misconceptions, MicroStrategy’s Bitcoin holdings far exceed its debt burden. A common myth is Saylor’s “$75,000 average Bitcoin price” triggers automatic liquidation below that point. This is false.

What Price Would Actually Pressure MicroStrategy?

MicroStrategy would only face default risk if Bitcoin’s price dropped dramatically — near $10,400, about a 90% crash from current levels.

Why?

- The company doesn’t have margin calls or forced liquidation triggers based purely on BTC’s short-term price.

- Their convertible debt means they can repay bonds by issuing shares if necessary, not forced Bitcoin sales.

A Massive Dividend Reserve: 21 Months Covered

MicroStrategy just created a $1.44 billion cash reserve in just eight days — a fund dedicated entirely to paying dividends to shareholders.

What does this mean?

- This reserve covers about 21 months of dividend payments under current conditions.

- Even if Bitcoin price stagnates, shareholders are protected from dividend interruptions for nearly two years.

- The company aims to maintain 12 to 24 months of dividend coverage in cash reserves continuously.

Answer Box: Does Michael Saylor Plan to Sell His Bitcoin Holdings?

No, Michael Saylor has not confirmed selling his Bitcoin holdings. He acknowledged that MicroStrategy could sell Bitcoin or derivatives if it benefits shareholders. However, current financials indicate no imminent need to liquidate, as MicroStrategy’s Bitcoin assets outweigh its debts and it holds substantial cash reserves for dividends.

What Could Go Wrong? Risks to Watch

- Extreme Bitcoin Price Drop: If Bitcoin collapses by over 90%, MicroStrategy could face difficulty servicing debt, possibly forcing asset sales.

- Convertible Debt Dilution: Issuing new shares to pay debt may dilute existing shareholder value.

- Market Volatility & Liquidity: Any Bitcoin sales, even if small, could impact market sentiment temporarily.

- Macro Conditions: Global economic shifts might pressure MicroStrategy’s debt servicing ability.

Investors should monitor ongoing company disclosures and market conditions carefully.

Actionable Summary

- Michael Saylor’s statement about potentially selling Bitcoin is speculative, not an action plan.

- MicroStrategy’s Bitcoin holdings dwarf its debt; liquidation triggers only at extreme price crashes.

- The company built a $1.44B dividend reserve, ensuring nearly two years of dividend payments without Bitcoin sales.

- Bitcoin price only needs a modest rise (~1.35% annually) for dividends to remain sustainable.

- Overall, MicroStrategy remains financially healthy, reducing risk of forced Bitcoin sales.

Why Track MicroStrategy with Wolfy Wealth PRO?

MicroStrategy’s moves are signals that can sway markets. Wolfy Wealth PRO digs deeper with timely alerts, model entries, and risk management tools so you never miss critical shifts in large Bitcoin holders’ actions. Stay informed with clear analysis beyond headlines—get the full playbook in today’s PRO brief.

FAQs

Q1: Does MicroStrategy have a “liquidation price” for Bitcoin holdings?

No. Unlike margin accounts, MicroStrategy’s debt structure does not force automatic Bitcoin sale at a specific price.

Q2: How much Bitcoin does MicroStrategy hold compared to other companies?

MicroStrategy holds around 650,000 BTC, making it the largest corporate Bitcoin holder by far. The next largest public company holds about 53,000 BTC.

Q3: What is convertible debt and how does it benefit MicroStrategy?

Convertible debt can be repaid by issuing shares instead of cash or Bitcoin, easing liquidity pressure during downturns.

Q4: If MicroStrategy sells Bitcoin, how would that affect market prices?

Any large sales could put downward pressure short term, but current analysis suggests only small, controlled sales would occur.

Q5: Should I be worried about MicroStrategy dumping Bitcoin?

Currently, no. Financials and reserves indicate no imminent need. Monitor updates for changes.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider your risk tolerance before investing.

Get ahead in crypto investing with Wolfy Wealth PRO, where we decode market moves and deliver actionable insights straight to your inbox. Join today and navigate the crypto world confidently.

By Wolfy Wealth - Empowering crypto investors since 2016

Subscribe to Wolfy Wealth PRO

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile