The Case for a Four-Year Cycle Top

Historical Pattern Recognition

Looking at Bitcoin’s history, the four-year cycle has been remarkably consistent:

- December 2013

- December 2017

- November 2021

This repeating rhythm suggests that until a fundamental market shift occurs, the pattern is likely to persist.

Why the Cycle Could Repeat

- Psychological Entrenchment: The four-year cycle is deeply ingrained in the collective mindset of crypto investors.

- Self-Fulfilling Prophecy: Since many expect it, coordinated selling pressure can emerge, amplified by hidden leverage.

- Halving Effect: Historically, peaks occur 12–18 months after each halving due to supply shocks. While less convincing this cycle, it still matters.

- Occam’s Razor: The simplest explanation is often the most accurate – if the cycle worked three times, why assume this time is different?

With Bitcoin already showing significant gains from the cycle bottom, history suggests we may be approaching a peak window.

The Case for an Extended Cycle (2026 Thesis)

The Argument for Structural Change

The key question: Can a cycle driven by institutions look the same as those driven by retail speculation?

Cycles still exist, but they can be stretched or compressed depending on new dynamics.

Why This Time May Differ

- Institutional vs. Retail Behavior

- Spot ETF flows create new liquidity dynamics, very different from traditional exchange-driven retail flows.

- Institutional profit-taking tends to be systematic, not panic-driven.

- Traditional Indicators May Fail

- Metrics like NVT and MVRV were calibrated on retail-dominated cycles.

- With institutional capital, what counts as “overheated” has shifted.

- BTC, when priced in gold, hasn’t even cleared its last cycle highs – hardly a bubble.

- Regulatory Environment Transformation

- For the first time, the U.S. and SEC have provided frameworks that encourage institutional involvement.

- Earlier cycle tops often coincided with regulatory shocks, like the 2018 ICO crackdown. That risk is diminished.

- Macro and Federal Reserve Dynamics

- Jerome Powell’s term ends May 2026. Trump is expected to nominate a replacement in late 2025.

- Anticipation of a dovish replacement could sustain a “goldilocks” environment until mid-2026.

- Historical precedent: both Yellen → Powell (2018) and Bernanke → Yellen (2014) saw equities drop shortly after transitions. A similar correction in 2026 could align with a crypto cycle top.

- Evolved Market Structure

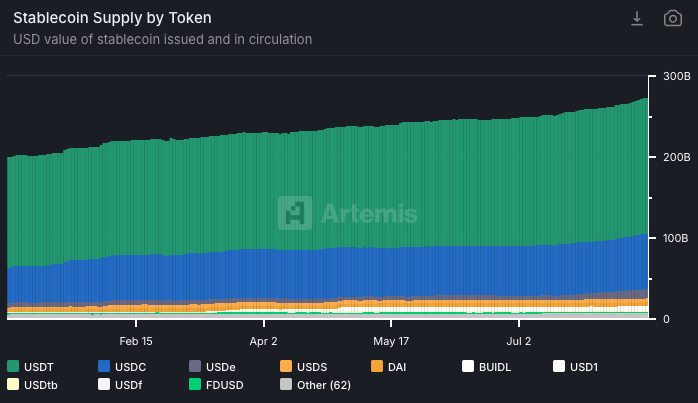

- Stablecoins act as “dry powder” and continue to expand, fueling demand.

- Demand drivers are more diverse: ETFs, pensions, and new digital asset trusts (DATs).

- Currency debasement concerns reinforce Bitcoin’s long-term bid.

Bearish Wildcards That Could Shorten the Cycle

- DAT Leverage Risk (Strategy, BitMine, Sharplink...): If large digital asset trusts unwind positions rapidly, forced selling could spark downside pressure.

- Macro Risks: Persistent inflation could force tighter monetary policy, weighing on crypto.

Missing Ingredients for a Cycle Top

- Lack of Euphoria: Every correction sparks fear rather than mania. True cycle tops are usually marked by overconfidence and blow-off tops.

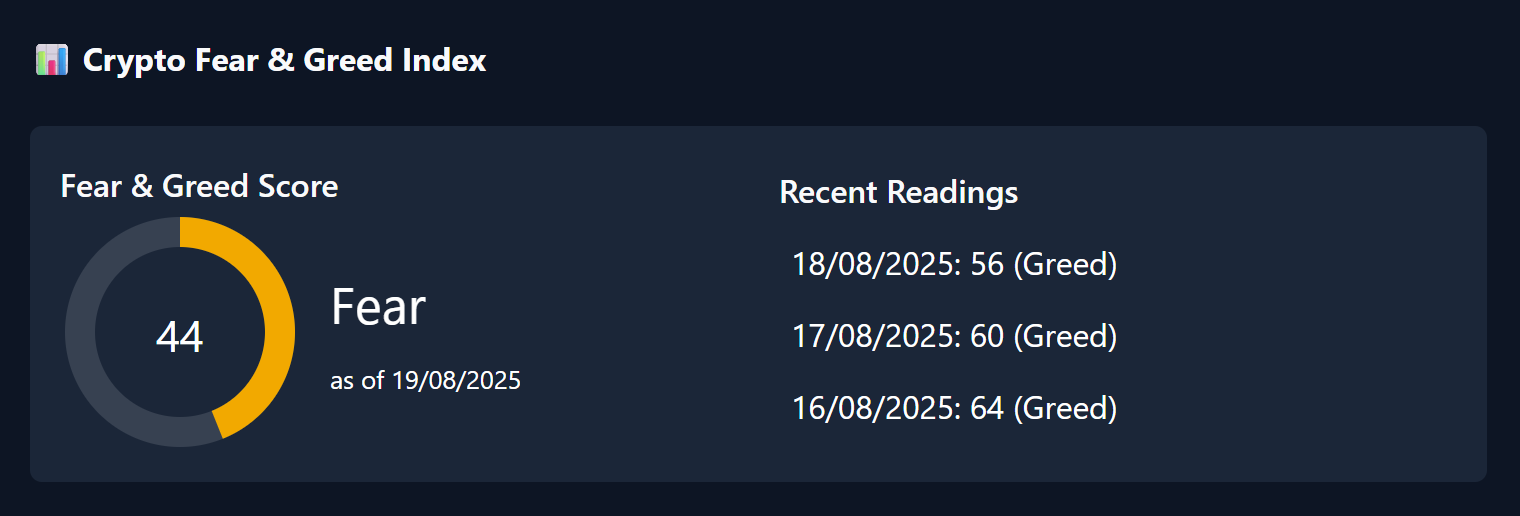

Normally at peaks we see "extreme greed" for several days in a row, this is far from happening. Check it Here

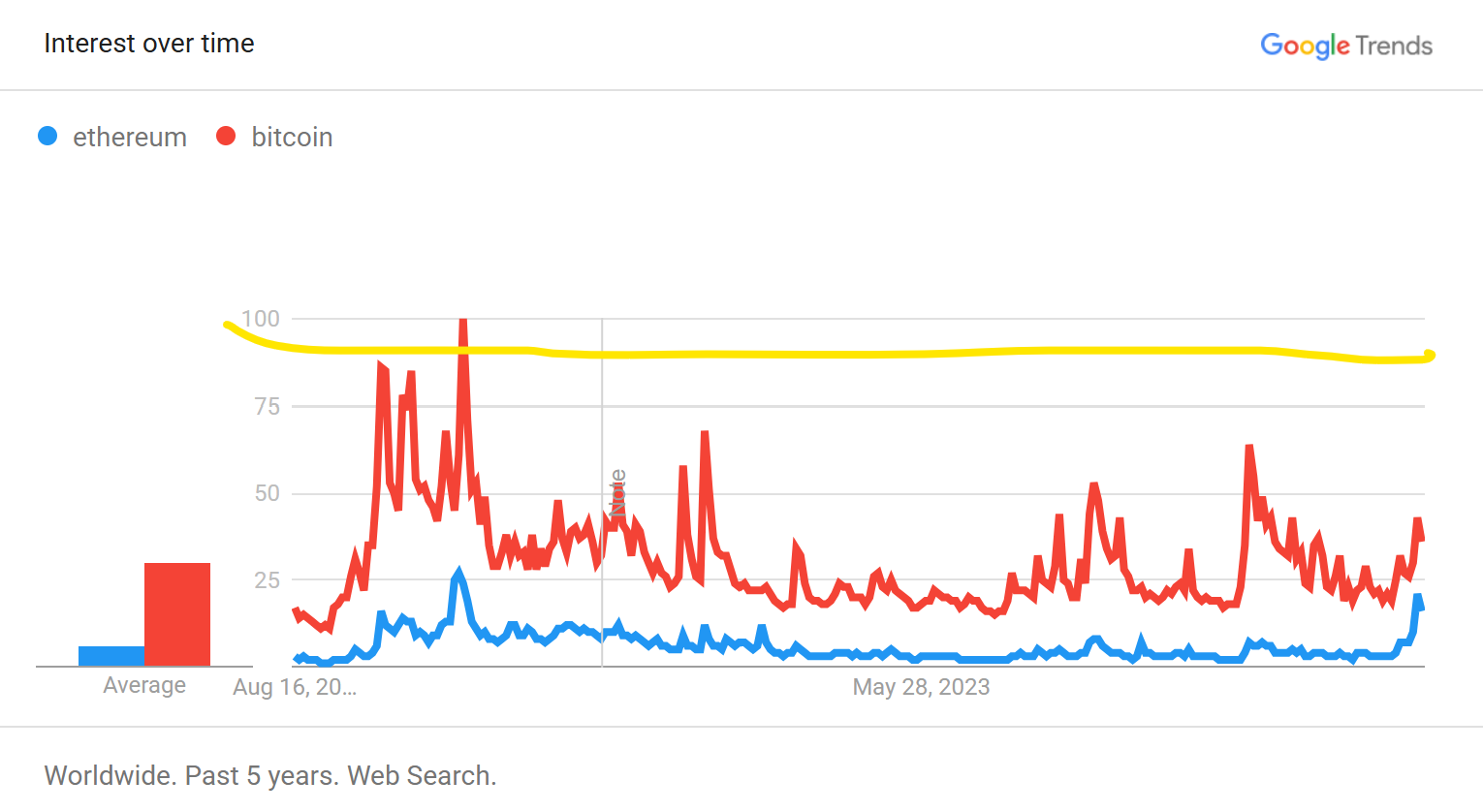

Bitcoin and Ethereum searches on Google have increased, but are still far from reaching the top of 2021. Check it Here

- Stablecoin Growth (Artemis): Historically, cycle peaks occur when stablecoin supply stagnates. So far, supply continues to expand, suggesting fuel remains.

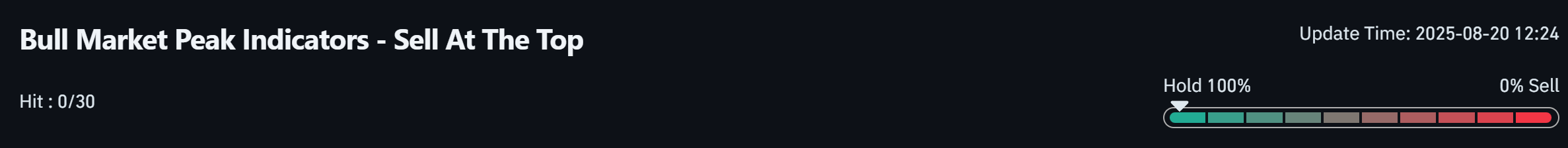

- No Bull Market Indicators Hit Top Yet (CoinGlass)

Current View

At Wolfy Wealth, we lean toward an extended cycle into 2026:

- The Fed transition provides a powerful macro tailwind.

- Institutional adoption changes the rhythm of the market.

- Euphoria and blow-off signals are still absent.

That said, the four-year cycle has a strong track record and could yet prove decisive. Awareness of the cycle itself might create a self-fulfilling top.

Want to know our investments and our positioning?

Become PRO

Final Thoughts

- Four-Year Cycle Top Case (2025): History supports it, and simplicity has worked before.

- Extended Cycle Case (2026): Institutional structure, regulatory clarity, Fed dynamics, and stablecoin expansion suggest more runway.

The key takeaway:

- You cannot time the absolute peak.

- Build a systematic exit strategy that balances profits with peace of mind.

- Selling “too early” is never a mistake if it locks in meaningful gains.

By Mike

Wolfy Wealth - Crypto Insights

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile.