Tokenized Stocks , The Next Big RWA Trend?

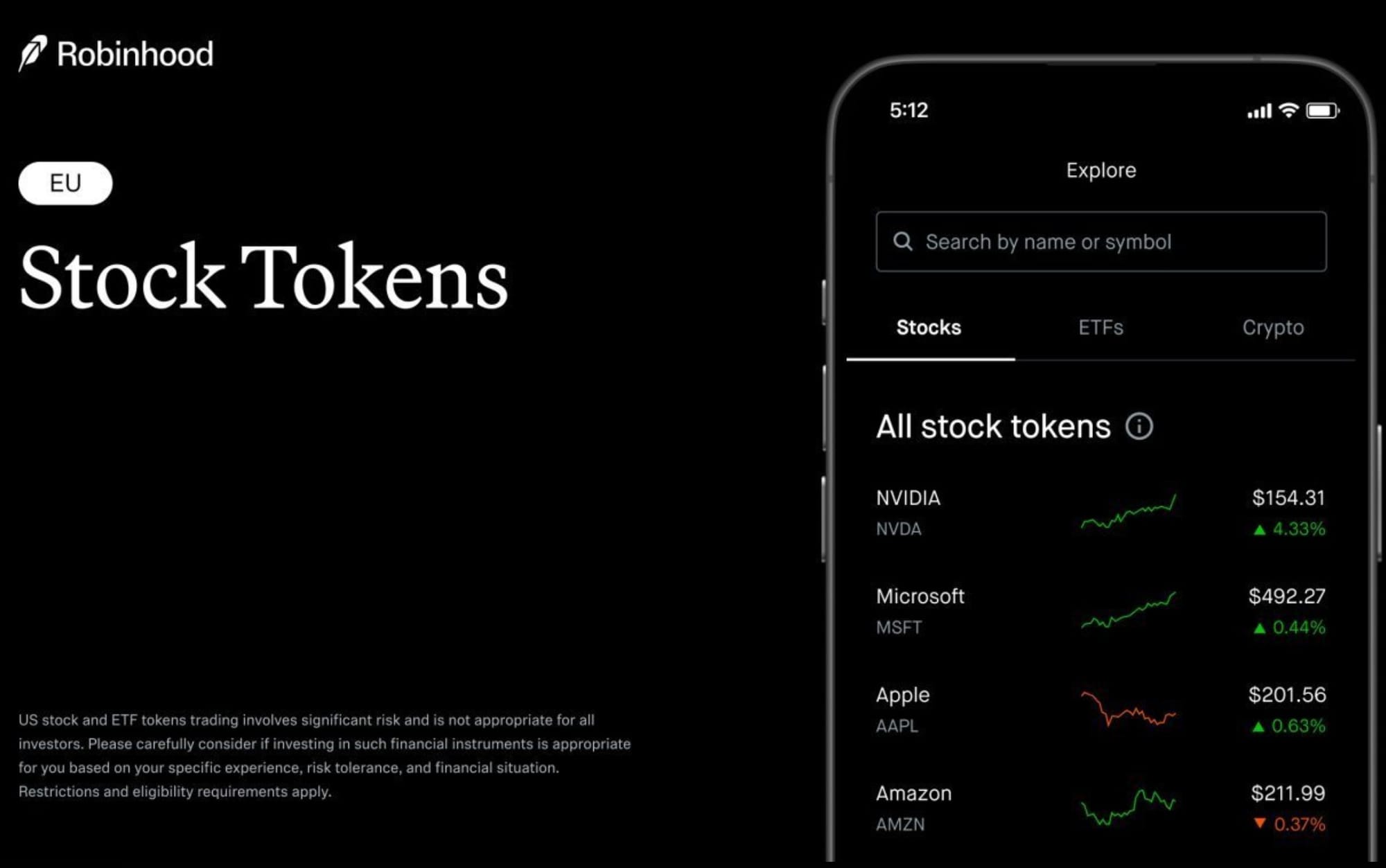

Robinhood Enters the RWA Space

Earlier today, Robinhood made a major announcement that’s already making waves in the crypto space. The company revealed it will be offering tokenized shares of private giants like SpaceX and OpenAI through its own blockchain, called Robinhood Chain, which was developed using Arbitrum’s technology stack.

In addition to that, more than 200 tokenized stocks and U.S. ETFs are now available on the Arbitrum blockchain, specifically for users in the European Union via the Robinhood app. With Robinhood Chain, the platform aims to bring these tokenized assets even deeper into the DeFi ecosystem.

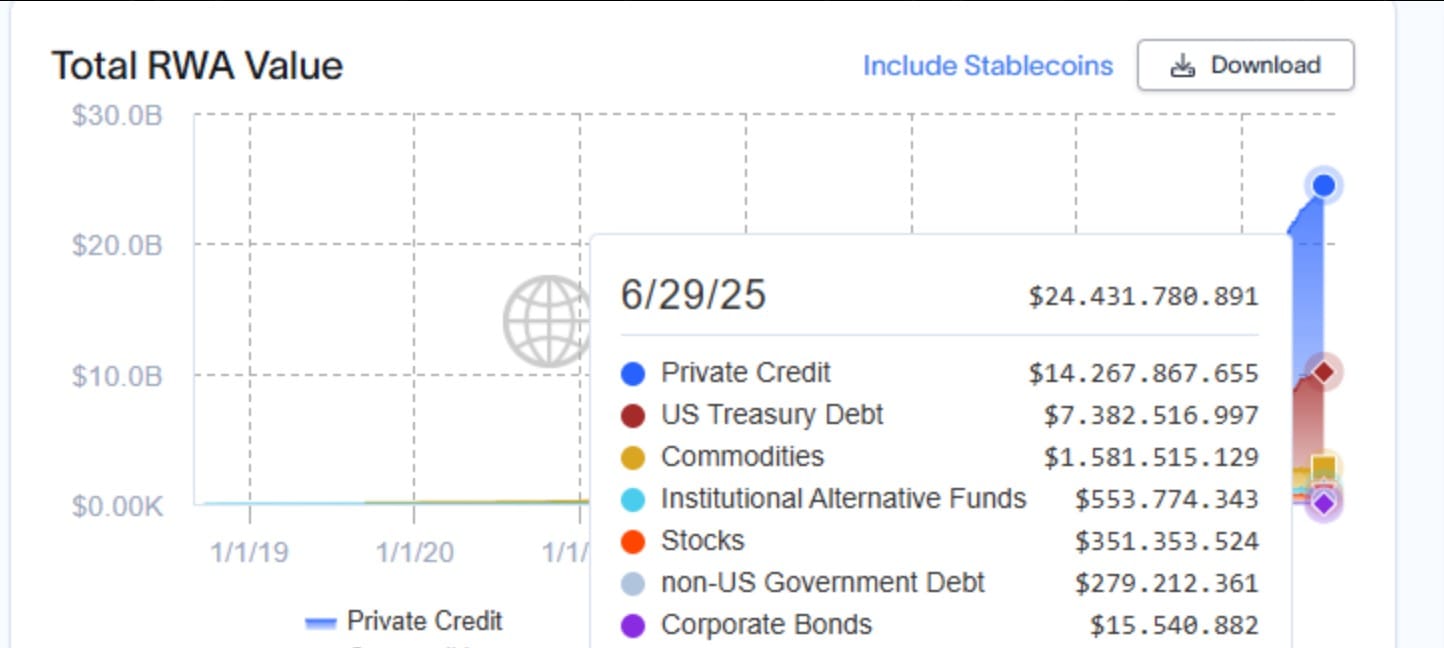

Current Landscape

Today, tokenized stocks represent only the fifth-largest category of tokenized assets on blockchain networks. That means there's significant room for growth, making tokenized equities a strong contender to become the next major trend in the Real World Asset (RWA) sector.

Coinbase is also moving in this direction, seeking SEC approval to list tokenized stocks in the U.S.—a sign that we are entering a regulatory race between exchanges to dominate this emerging trading flow.

As regulatory clarity improves, the pace of growth in this asset class could accelerate. Larry Fink, CEO of BlackRock, recently stated that "the financial rails of the future for stocks will be on-chain"—a statement that underscores the importance of clear and supportive regulation.

Who Stands to Gain?

In the early stages of this movement, the blockchains that manage to attract the most tokenized assets will likely draw increased market attention, especially if they establish strong partnerships.

Ethereum is currently in the best position to benefit, given its infrastructure and ecosystem maturity. However, Solana also remains a strong contender, particularly if it continues to scale and integrate with key players in the RWA space.

What to Expect from the Market This Week

The market has entered a quiet phase following the de-escalation of tensions between Iran and Israel. However, July is shaping up to be a crucial month for the crypto sector.

Key themes for the coming weeks will revolve around two major factors: interest rate cuts and tariff developments.

Both could significantly impact market sentiment and price action, making it a month to watch closely.

We will talk about our Macro expectations and what we are buying tomorrow in the Wolfy Wealth Premium Report.

Tom Lee converting a bitcoin mining company to an ETH treasury and staking company.

Bitmine names Fundstrat’s Thomas Lee as Chairman and closes $250M private placement backed by top-tier investors. Proceeds will fuel a bold Ethereum treasury strategy

The ETH thesis for @fundstrat is simple.

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams) June 30, 2025

He's frontrunning ETH accumulation by the banks.

"Ethereum is also the architecture that future banks will have. When goldman issues a stablecoin and JPMorgan doing it on Ethereum as Layer 1 blockchain they're going to want to secure it… pic.twitter.com/MyyJz94rXw

We have a big month ahead, be patient and don't chase the hype.

By Mike

Wolfy Wealth - Crypto Insights

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile.