In 2026, Washington D.C. has become the center of one of the most important financial battles of the decade. At its core, this is a fight over who controls digital money and who captures the yield generated by it.

On one side are traditional banks, the incumbents of the legacy financial system. On the other are crypto-native platforms like Coinbase, which are actively disrupting how savings, payments, and yield work in a digital economy.

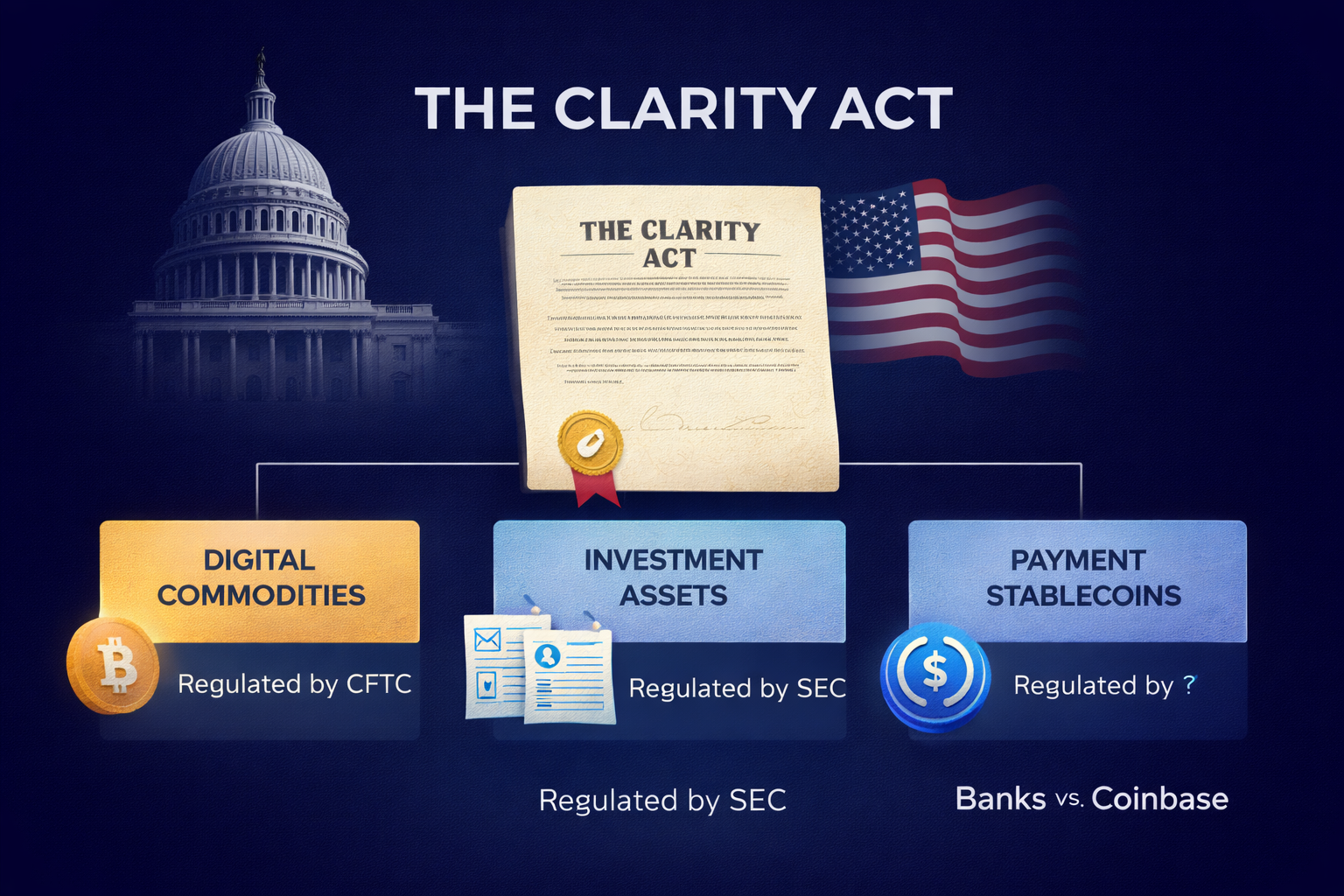

At the center of this conflict is a new regulatory framework known as the CLARITY Act.

For crypto investors, this is not politics for politics’ sake. The outcome directly affects capital flows, stablecoin adoption, DeFi growth, and long-term valuation across the entire crypto market.

What the CLARITY Act Actually Does

The CLARITY Act aims to end years of regulatory uncertainty by clearly defining how digital assets are classified and regulated in the United States.

It divides crypto into three main categories:

- Digital commodities, such as Bitcoin, regulated by the Commodity Futures Trading Commission

- Investment assets, tokens that behave like securities, regulated by the Securities and Exchange Commission

- Payment stablecoins, digital dollars designed to maintain a one-to-one peg with the US dollar

This final category is where the real economic battle is taking place.

Why Stablecoins Are the Real Threat to Banks

Stablecoins are effectively digital dollars that move instantly, globally, and at near-zero cost. The most widely used models are fully reserved, meaning each token is backed by real dollars or short-term US government bonds.

The importance for investors is simple. Stablecoins remove friction from capital movement, unlock onchain yield opportunities, and allow users to earn returns that traditional banks historically keep for themselves.

This creates a direct competition with the traditional banking model.

The Yield Problem , Why Banks Are Losing the Argument

Under the traditional bank model, depositors receive minimal interest, while banks deploy that capital into government securities and keep the majority of the yield.

In contrast, crypto platforms allow users to access a meaningful portion of that yield directly, either through stablecoin rewards or DeFi strategies. This flips the incentive structure and makes stablecoins fundamentally more attractive for savers.

In early 2026, major bank executives warned lawmakers that trillions of dollars could migrate from bank deposits into stablecoins. If that happens, banks lose cheap funding, compress margins, and weaken their core business model.

For crypto markets, this potential capital migration represents a massive structural inflow opportunity.

The Legal Loophole That Changed the Game

A prior US law restricted stablecoin issuers from directly paying interest. Traditional banks assumed this would neutralize competition.

However, Coinbase exploited a critical distinction. It does not issue the stablecoin itself. It operates the platform where users acquire it. Because of this separation, Coinbase has been able to offer rewards without violating the letter of the law.

This loophole is now under attack.

In January 2026, Brian Armstrong publicly withdrew support for the CLARITY Act, arguing that banks were attempting to rewrite the rules to eliminate competition rather than improve consumer protection.

The Banks’ Real Strategy , Buying Time, Not Safety

The aggressive lobbying effort is not about protecting users. It is about delaying disruption.

Large banks are already working on their own digital deposit tokens and blockchain-based settlement systems. The problem is that their infrastructure is not ready, and their systems cannot yet compete with crypto-native platforms on speed, cost, or global accessibility.

By pushing amendments that restrict rewards today, banks aim to slow crypto adoption long enough to launch their own products later, ideally as the only compliant option left.

This is a defensive strategy, not an innovation strategy.

Why This Is Bullish for Crypto Long Term

For investors, this battle highlights something critical. Crypto is no longer being debated as a fringe technology. It is being treated as a systemic threat to legacy finance.

Regulatory clarity, even when contested, tends to unlock institutional capital, accelerate adoption, and increase the value of compliant crypto infrastructure. History shows that systems which are faster, cheaper, and more rewarding to users tend to win over time.

In the short term, volatility and political noise are likely. In the long term, the shift toward digital, onchain finance strengthens the investment case for crypto assets and platforms positioned on the right side of regulation.

For patient investors, this is not a reason for fear. It is evidence that crypto is competing at the highest level, and that competition is where the largest profit opportunities emerge.

Wolfy Wealth - Crypto Insights

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile.