Solana’s Centralization Problem: What Investors Should Know

In the fast-paced world of crypto, narratives shift quickly. But as excitement around Solana continues to grow, it is worth revisiting the network’s controversial foundations and ongoing structural challenges. Many seem to have forgotten that Solana was once the favored chain of Sam Bankman-Fried and FTX, embraced by many new-age intermediaries precisely because it was easy to influence and control.

While market hype often overshadows fundamentals, Solana’s history and architecture reveal significant risks that investors should not ignore.

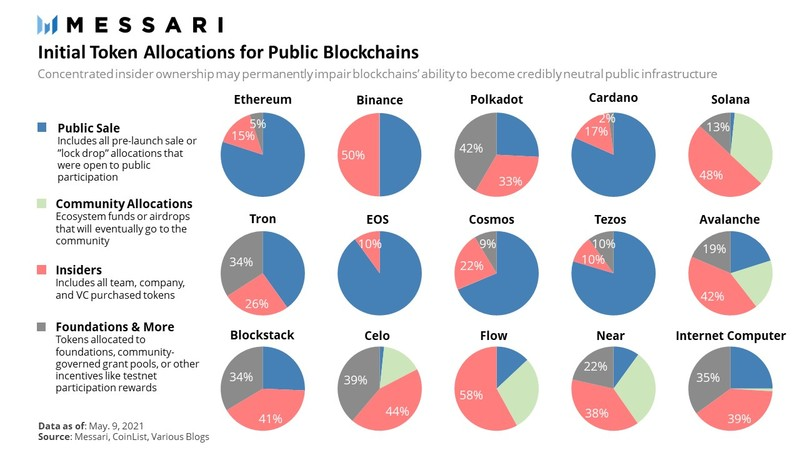

Concentrated Token Distribution

Solana’s initial coin offering raised eyebrows from the start. Nearly half (48%) of the total allocation went directly to venture capital firms, while just 1% was offered to the public. This imbalance created an ecosystem dominated by insiders from the very beginning, leaving everyday investors with minimal access to early supply and creating a foundation for price manipulation.

Adding to the perception of artificial growth, Solana’s reported high transaction throughput has long been inflated by bot activity, masking its real organic usage.

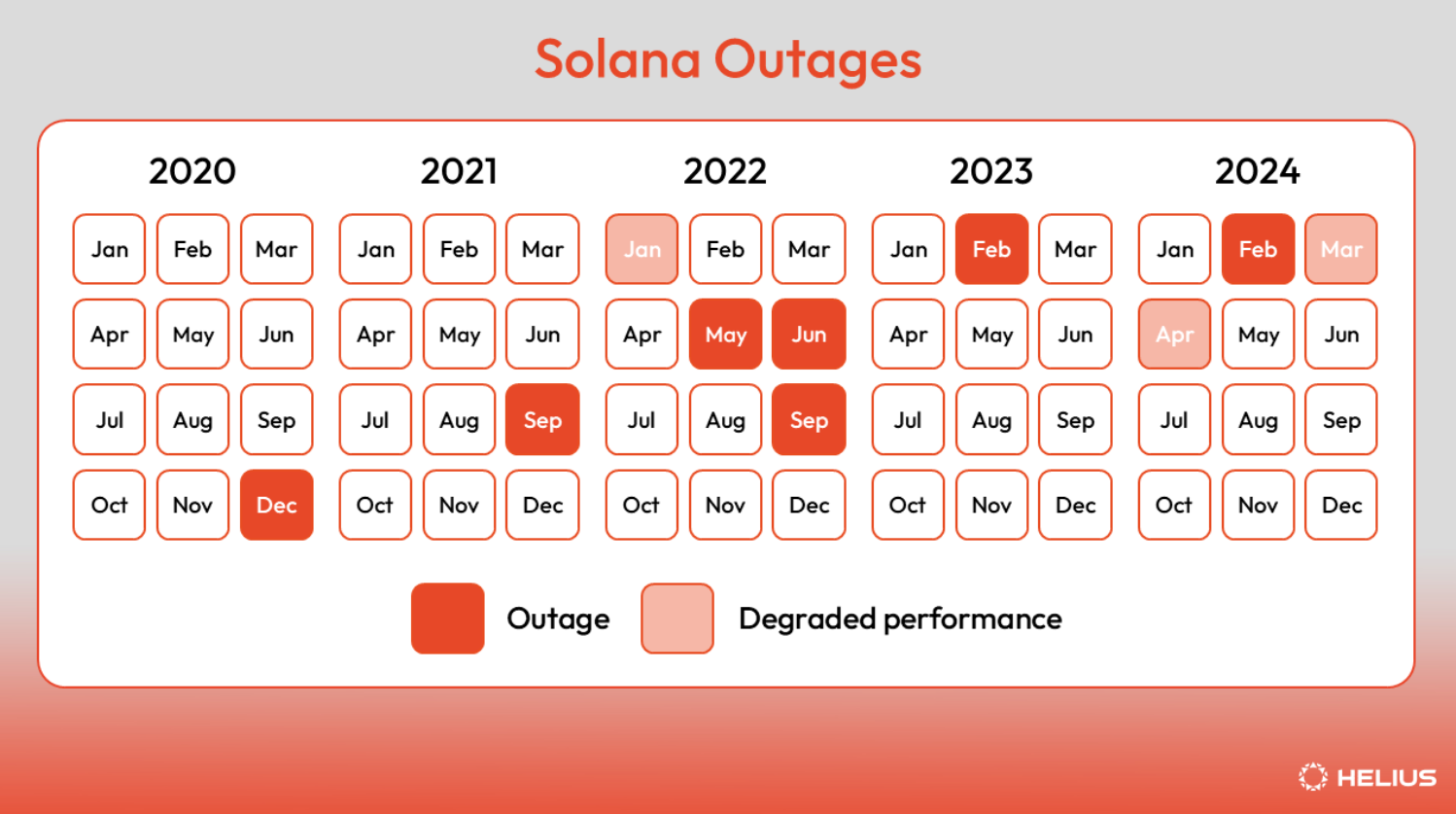

Fragile Network Reliability

Beyond tokenomics, Solana has faced ongoing technical instability. The network has suffered multiple outages that required manual restarts by its core developers. This raises serious concerns about its resilience and decentralization, especially for a blockchain that claims to be ready for mass adoption.

Validator Centralization

Solana’s validator structure also raises red flags. The top 25 validators control approximately 46.3% of all staked SOL, while the top 5 alone control more than 16.4%. Such concentration places decision-making power in the hands of a few large players, undermining the decentralized ethos that underpins blockchain technology.

Running a validator on Solana also demands enterprise-grade hardware — hundreds of gigabytes of RAM and high-performance SSDs — making it nearly impossible for average participants to join. This restricts validator participation to well-capitalized institutional operators such as Binance and Coinbase, further centralizing control.

Solana does NOT have a Nakamoto Coefficient of 19.

— DBCrypto (@DBCrypt0) September 1, 2025

It is not even half of that.

Even @0xMert_ admits it.

Stop trusting influencers parroting analytics sites.

Some of them know the truth, and still spread lies. pic.twitter.com/7CGPFJ9ClF

Unsustainable Growth Model

Solana’s raw ledger data has already grown to nearly half a petabyte, an enormous size that threatens long-term sustainability. The network’s account model and pruning approach make it dependent on enterprise-level archival providers to maintain historical data. This design choice erodes independent verifiability, locking the ecosystem into a reliance on trusted third parties rather than trustless, decentralized validation.

BREAKING: There are now 100 million bots total on major crypto networks

— DBCrypto (@DBCrypt0) September 17, 2025

85 million of them call Solana home 🤯 pic.twitter.com/uvUqhXvfbn

The Bottom Line for Investors

Solana’s rapid rise has been driven by hype, speculation, and a tightly controlled ecosystem dominated by insiders. While the network has attracted developers and capital, its combination of centralization, fragility, and heavy infrastructure demands poses serious risks to long-term investors.

As crypto matures, sustainable networks will be those that prioritize decentralization, verifiability, and resilience. For investors seeking exposure to reliable and transparent ecosystems, Solana’s design raises fundamental questions that cannot be ignored.

By Mike

Wolfy Wealth - Crypto Insights

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile.