Market Overview: Is the Bull Run Over? Wolfy Wealth Weekly Report

The recent market fluctuations have sparked debates about whether this bull cycle is nearing its end, but the reality is that the rally remains intact. While our previous analysis highlighted the potential for short-term pullbacks—common in healthy bull markets—these corrections are natural and not cause for alarm. However, we are likely approaching the later stages of this cycle.

Over the past week, the crypto market cap stands at $3.97 trillion, down 1.6%. Bitcoin maintains dominance at 59%, valued at $2.34 trillion (~$117,600), while Ethereum holds 13.4% with a $534 billion market cap. Altcoins (excluding Ethereum) collectively total $1.1 trillion, showing resilience despite Bitcoin’s dominance. However, they are currently losing value relative to Ethereum. The Fear & Greed Index sits at 57, straddling neutral territory. Check it HERE

Ethereum Demand Surges

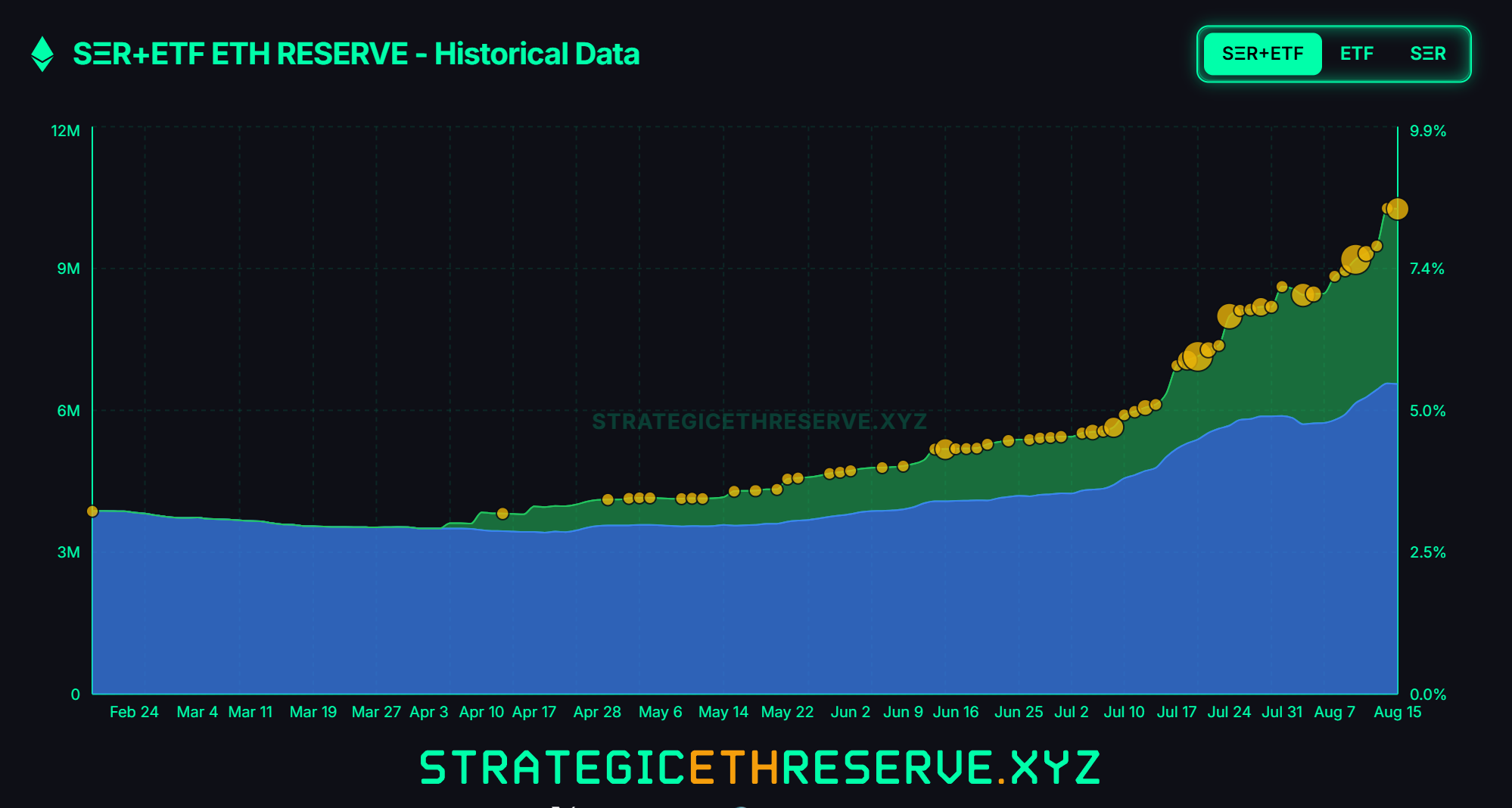

As “Ethereum season” gains momentum, demand for ETH has skyrocketed. Notably, Tom Lee’s Bitmine has publicly targeted accumulating 5% of Ethereum’s total supply, rapidly closing in on this goal at a pace outpacing MicroStrategy’s Bitcoin buys. Currently holding ~1% of ETH’s supply, Bitmine emphasizes this as a strategic, multiyear macro play.

Meanwhile, Ethereum’s potential to overtake Bitcoin in market cap within a year—suggested by Joseph Lubin—adds both optimism and caution. Historically, such “flippening” speculation often signals late-stage market sentiment, which can be a double-edged sword for price movements.

Stablecoins and the GENIUS Act

The recently passed U.S. GENIUS Act paves the way for a CBDC-like system under the guise of stablecoin regulation, enabling U.S. dollar dominance. This move could squeeze weaker currencies by offering easy access to USD, funneling capital into a private, U.S.-controlled digital dollar. While this may temporarily bolster the USD, it risks exacerbating inflationary pressures and centralization.

This underscores the critical need for decentralized alternatives like Bitcoin, which empower individuals to transact freely and protect their wealth from systemic corruption and inflation.

What’s Next?

Expect heightened volatility and emotional decision-making as markets near their peak. Discipline is key—resist impulsive moves driven by greed or fear. Stick to your original strategy and avoid justifications for deviating from it. Emotional reactions are natural but dangerous in late-cycle markets.

Stay tuned for our ongoing updates to navigate these dynamics with clarity.

By Mike

Wolfy Wealth - Crypto Insights

Disclosure: Authors may be crypto investors mentioned in this newsletter. Wolfy Wealth Crypto newsletter, does not represent an offer to trade securities or other financial instruments. Our analyses, information and investment strategies are for informational purposes only, in order to spread knowledge about the crypto market. Any investments in variable income may cause partial or total loss of the capital used. Therefore, the recipient of this newsletter should always develop their own analyses and investment strategies. In addition, any investment decisions should be based on the investor's risk profile.